Q1 2022 Handshake Market Sentiment Report

Santa delivered a sleigh-full of survey responses regarding namer demographics, market sentiment, and opinions about ecosystem development.

Happy New Year!

I’m excited to present the first-ever Handshake Market Sentiment Report. Thanks to enthusiastic and thoughtful survey participation from the global Handshake community, the report gives insight into how users interact with the protocol, determine the value of top-level domains (TLDs), and perceive the state of Handshake ecosystem development.

During the two-week response period, 80 members of the Handshake community completed the Market Sentiment Survey. Based on self-reported information, this population hails from four continents, speaks at least nine primary languages, and includes both newcomers to Handshake and old-timers. In the aggregate, survey respondents have purchased more than 36,000 TLDs at auction and on the secondary market and have resold nearly 1,000.

This report combines survey responses with additional data and brief closing commentary. Readers who wish to review the raw aggregate survey results may access them here.

Thank you to the Handshake community for your interest and participation in this effort. From all of us at blockdomains/, we look forward to finding ways to contribute to the Handshake community in 2022 and beyond, and wish you the best in the new year.

Sincerely,

Colin

blockdomains/

Introduction and Key Findings

2021 marked a year of significant activity in the world of Handshake, even after release of the survey on December 20, particularly Opera’s announcement that they will integrate Handshake. A December uptick to secondary market volume and a strong start to January suggest increased enthusiasm. As the Handshake community grows and evolves, along with growth in technological adoption of the protocol and general awareness, resources that document and orient users will become even more vital.

Based on your survey responses, we now have a clearer picture of how this population interacts with and perceives the Handshake protocol. Despite a great diversity of backgrounds and opinions, certain trends emerged:

· Buy to hold – Relying on the low end of the ranges of bought/resold TLDs, survey respondents have purchased over 37 times more TLDs than they have resold.

· Tech first – Although the majority of all respondents indicated likelihood to recommend Handshake to another person based on both technical merits and investment potential, enthusiasm for technical merits demonstrably outstripped that for investment potential.

· Practical optimist– Respondents expressed optimism about market conditions, with pockets of skepticism and frustration regarding select areas of ecosystem developments, particularly transaction-related services for the secondary market.

Further findings and related commentary are organized around these topics:

1. Population and behavior – Who interacts with Handshake and how?

2. Inherent value – What constitutes a valuable TLD?

3. Market sentiment – How do respondents perceive primary and secondary market conditions and what are their expectations for different TLD categories? Monthly volume trends and charts tracking top TLD sales are also provided for reference.

4. Ecosystem satisfaction – Which categories have overdelivered and which are perceived to have room for improvement?

5. Closing thoughts – Why is data like this worth collecting and sharing?

It might be safe to assume that a population willing to complete a 26-question survey about Handshake includes an overrepresentation of diehards, so readers may choose to factor in a certain optimism bias in interpreting results. In addition, although we made efforts to spread the survey far and wide through various Handshake-related forums, there is no guarantee that the survey sample is representative of the global Handshake ecosystem, particularly since the survey was made available in English only.

Despite these limitations, the 80 survey respondents represent a material subset of the Handshake community and significant collective TLD ownership. I hope that readers will find their responses as interesting as I did in compiling this report.

Population Definition

Handshake has attracted interest from individuals who represent a variety of backgrounds and skillsets. Nearly all respondents (92%+) identified at least somewhat with the roles of TLD and HNS Coin Investor. Almost 70% identified somewhat or strongly with the Creator/Builder role, and about half reported some/strong identification with Developer/Programmer and SLD Investor roles. Although the survey population clearly tilts toward an investor mindset, the significant technical segment of the population helps to ensure a balanced perspective regarding later topics.

Respondents also wrote in additional roles. Notable write-ins included “advocate,” “evangelist,” “miner,” “freedom fighter,” and “legacy DNS name investor.” Other respondents noted their interest in educational and TLD gifting activities.

Over half of respondents (56%) reported involvement with Handshake for at least one year. The remainder were about evenly split between (1) those involved between six months and one year and (2) those involved between one and six months. A brave handful of respondents even reported involvement for less than one month!

The graphic below summarizes respondents’ characterization of their role within Handshake and lengths of involvement.

Having established some demographics of survey respondents, even more intriguing questions pertain to how they interact with Handshake. Survey questions surrounding the amount of TLDs purchased and resold suggest enthusiasm for acquisitions coupled with relative reticence to sell, which is consistent with a net optimistic outlook for TLD valuations (covered in a later section).

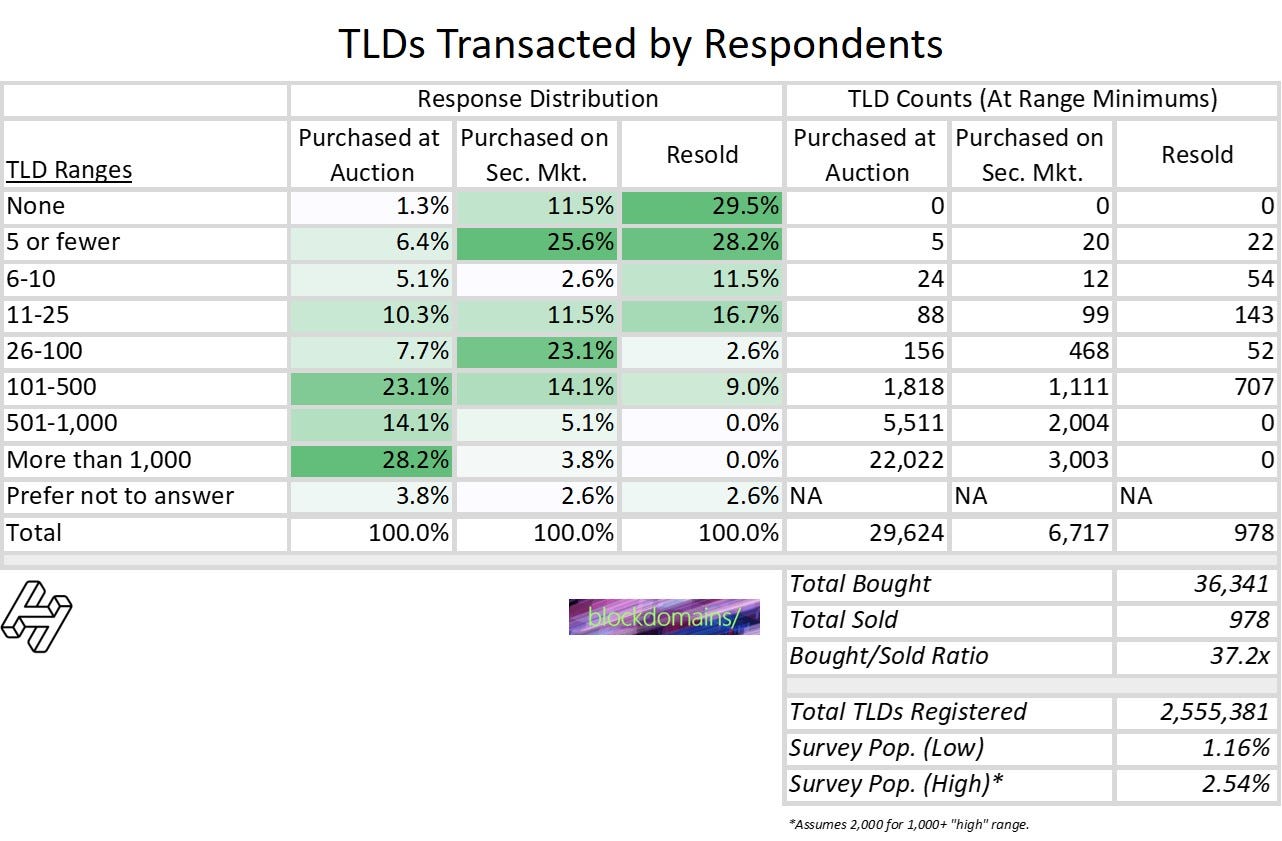

This table summarizes respondents’ counts of TLDs (1) purchased at auction, (2) purchased on the secondary market, and (3) resold.

The survey questions used numerical ranges, rather than specific counts, to preserve some privacy for respondents. Extrapolating based on the low end of each range, respondents have purchased over 36,000 TLDs in the aggregate, and have resold fewer than 1,000. As of December 31, 2021, an estimated 2.56 million Handshake TLDs had been registered. Using the low-end range of TLDs purchased at auction by respondents, the survey population represents registration of about 1.2% of total Handshake TLDs. Assuming high ends of each range instead, that share could be as high as 2.5%.

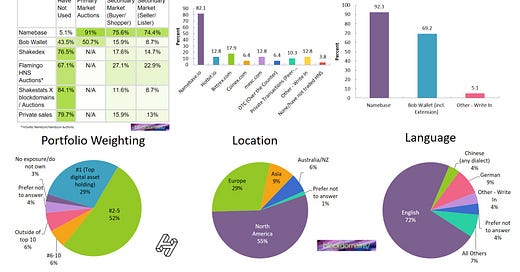

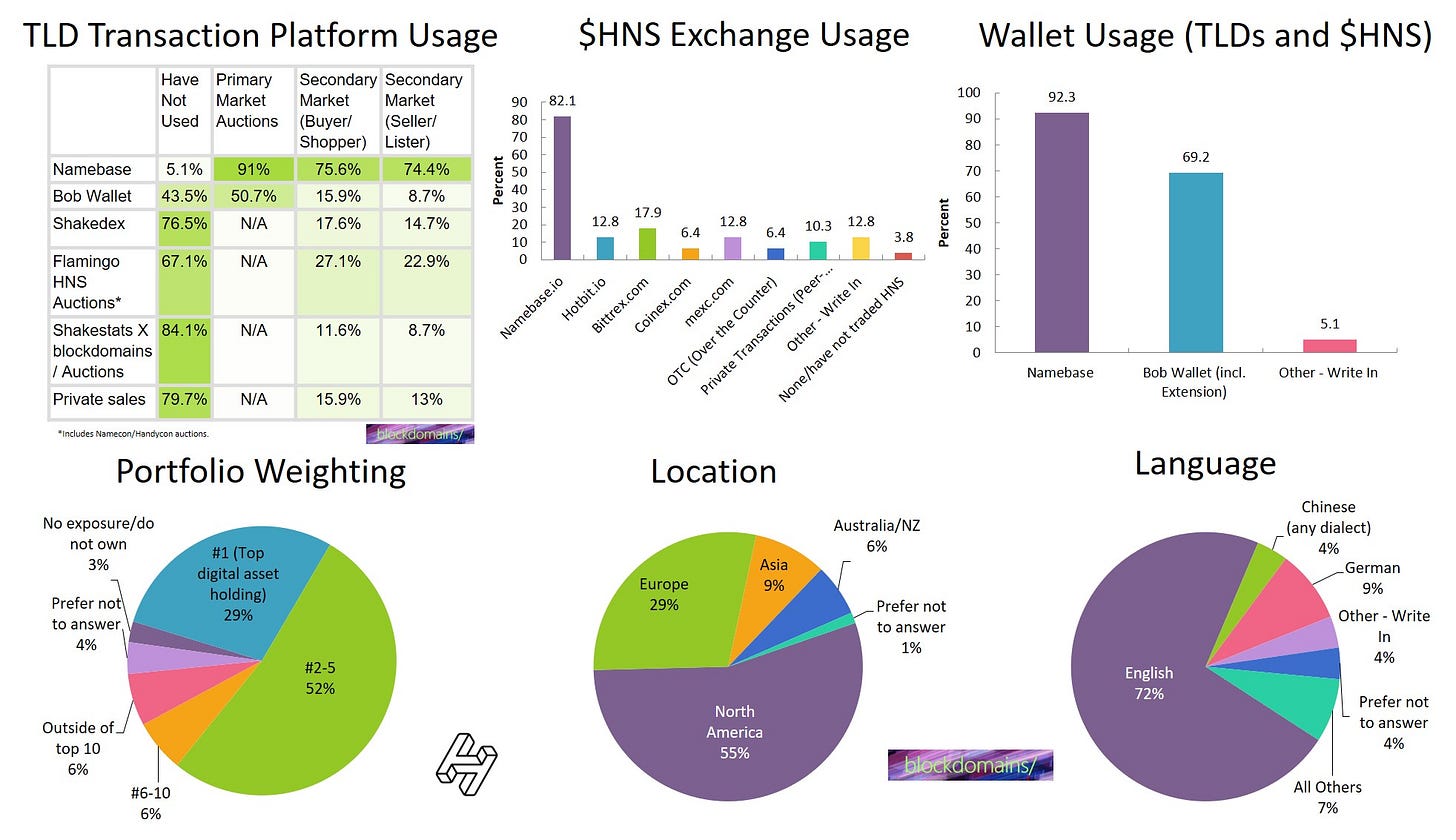

To round out the understanding of the survey population, a series of questions asked respondents about which programs and services they use to interact with Handshake, how heavily weighted they are in the project relative to other digital asset investments, and their locations and primary languages. The corresponding responses are summarized below.

Inherent Value

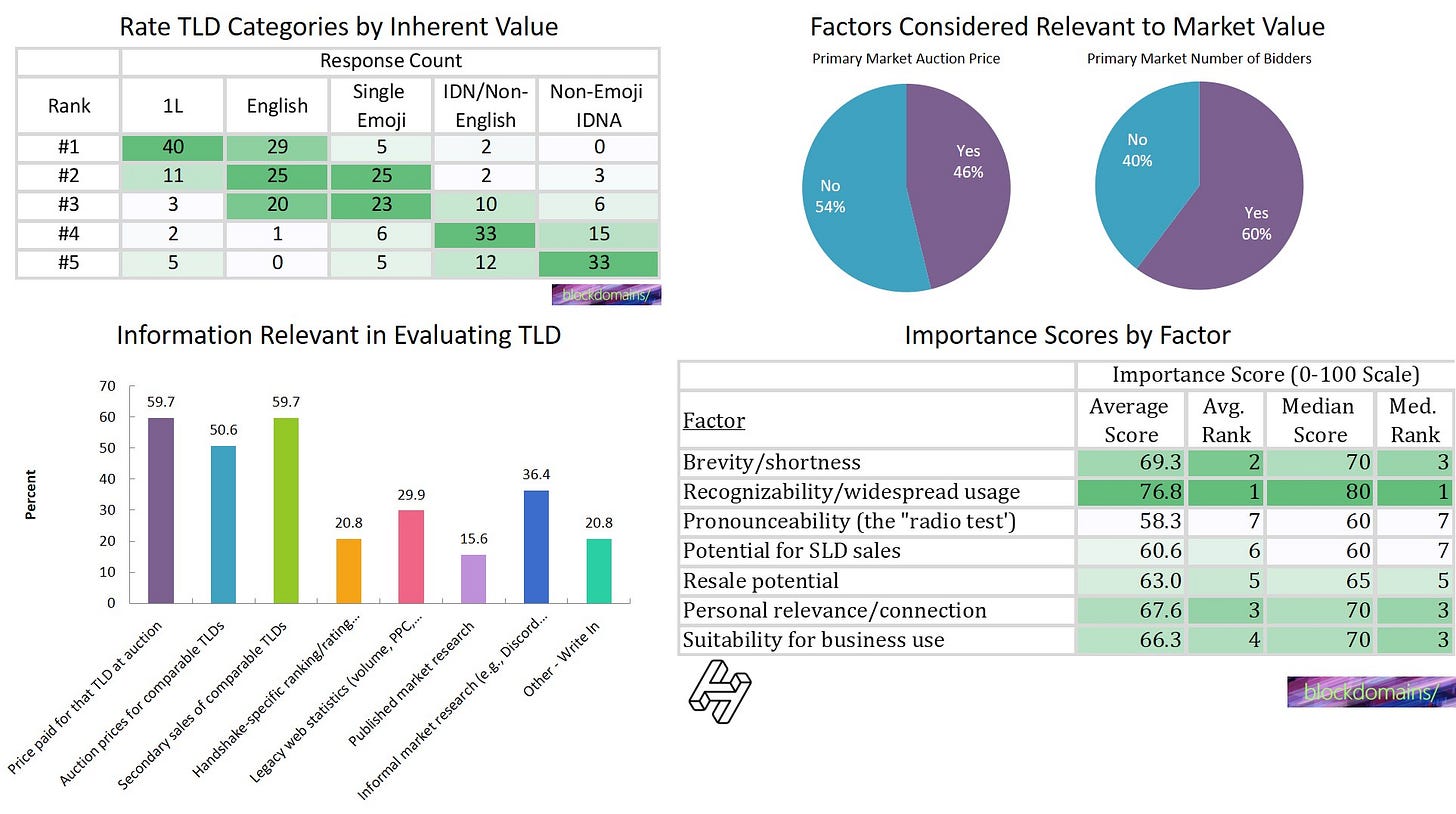

Before diving into respondents’ current TLD market sentiments, the survey probed for opinions regarding inherent value – what makes a TLD more or less valuable in absolute terms, independent of fluctuating market forces? In addition, we were interested in the characteristics and sources of information that respondents consider when evaluating/transacting TLDs. Many of the responses were unsurprising – brevity and recognizability are very important to many respondents, and 1L TLDs are considered to be the most valuable category by a plurality of respondents. Certain responses surprised the blockdomains/ team, however, such as the relative unimportance of TLD pronounceability.

Respondent opinions regarding the inherent value of TLDs is further summarized below.

TLD Market Sentiment

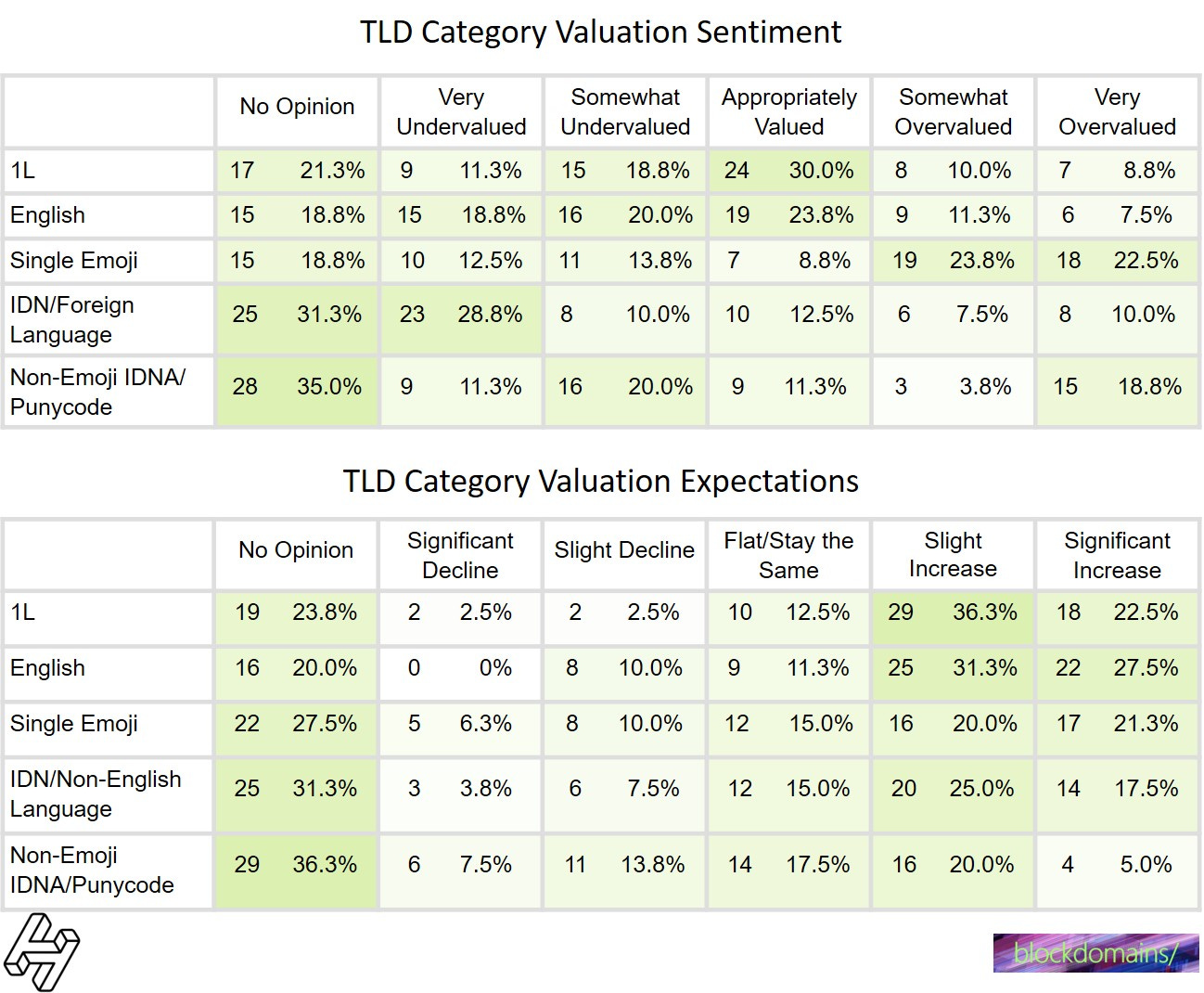

The survey questions focused on three topics regarding market sentiment: primary market activity, secondary market activity, and specific categories of TLDs. Questions probed for perspectives on past trends and outlooks for each. Respondents were generally more satisfied than not with past performance of the primary and secondary markets, and were generally more optimistic about the future than they were complimentary about the past. Expectations for TLD valuation trends were net positive across respondents and TLD categories, with more consensus around 1L/English TLDs compared to emoji/IDN.

It should be noted that the absence of SLD questions is not due to lack of interest, but merely a desire to keep the survey to a manageable length. Questions about SLD transactions/market sentiment are a goal for future surveys.

A more granular breakdown of respondent market sentiment is presented below, starting with primary and secondary market sentiment and expectations.

As a reference, the graph below reflects primary and secondary market trends from Handshake project inception through year-end 2021.

Respondents indicated general optimism regarding valuation trends of specific TLD categories, with some expressing no opinion, particularly regarding less mainstream categories. A significant segment perceived some degree of emoji TLD overvaluation, though a much smaller group expected corresponding valuation decreases in 2022.

The following charts plot the top reported 500 Handshake TLD secondary market sales – for purposes of readability, they are broken out across several charts. Readers will notice that the highest sale starts with #3. To make the charts as readable as possible, .nft and .p, which traded for a reported $84,000 USD and 375,000 $HNS, respectively, are excluded. Despite our best efforts, certain other transactions are tough to make out. In the event that readers would like to dig further into these transactions, Shakestats’ top-1,000 sales page is the source.

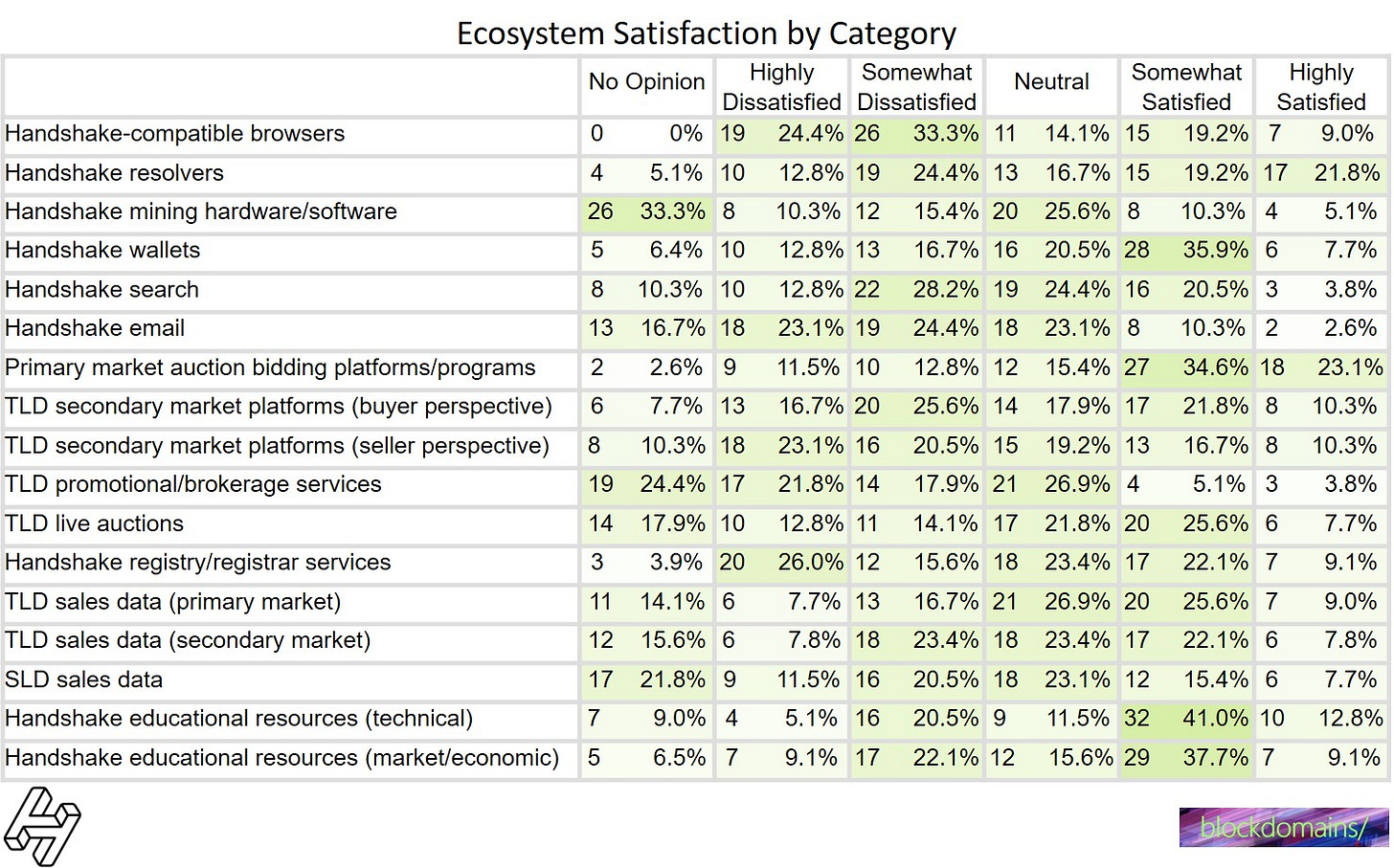

Ecosystem Satisfaction

Whenever users gather to discuss the protocol, opinions about Handshake-related services and features – and wish lists for new ones – abound. This survey is no exception. The final survey section collected opinions about overall satisfaction, as measured by the likelihood to recommend Handshake, as well as satisfaction with specific categories of services and programs within the ecosystem. Respondents were more likely than not to recommend Handshake based on both technical merits and investment potential, though enthusiasm for technical merits demonstrably outstripped that for investment potential.

The graphics below summarize these measures of overall and category-specific satisfaction. Responses to the final, write-in question of the survey, which requested any additional feedback, may be viewed as part of the raw aggregated survey results available here.

The blockdomains/ Story & Closing Thoughts

Given the wealth of information that survey respondents shared, it seems only fair that I disclose some background on how the blockdomains/ portfolio came into being, quantify some of those investment results, and explain the intent behind this report. My story in Handshake is similar to that of many survey respondents: as a relative newcomer to crypto about a year and a half ago, Handshake seemed particularly interesting and, next thing I knew, I had gone down the rabbit hole.

Over the course of August 2020 through January 2021, I purchased 55,000 HNS (initially with the intent to merely hold the coin or only acquire a handful of TLDs), making Handshake my top digital asset holding by a long shot. Quickly, I changed strategy and began participating in TLD auctions. Like many of you, I circled TLD release dates on my calendar, set my alarm clock for uncomfortable hours, and suffered the simultaneous indignity and glory of an account drawn down to zero available $HNS. As one thing led to another, I deployed a dLinks platform to resell TLDs, hired a spokesperson, helped organize some live auctions, started a market analysis blog, and even sort of got my wife on board.

Fast forward to today, I have purchased a little more than 5,000 Handshake TLDs at auction, bought close to 300 more on the secondary market, and resold about 700 for aggregate gross proceeds of approximately 500,000 HNS, of which about 30,000 has been donated to Handshake community organizations (plus a 1 ETH direct gift to the HNS Development Fund). Over time I’ve had the opportunity to transfer about 60 TLDs as gifts to raise awareness or as in-kind payment for Handshake services. HNS Name Claim is a fantastic resource to which I’ve gifted an additional 16 names so far. As I have come to know more owners and purchasers of TLDs, it has been enjoyable to connect buyers and sellers when I know of a good match. My plan is to hold many TLDs for a long time, and also to continue to buy and sell when attractive opportunities arise. In 2022 and beyond, I hope to find new ways to deliver value to buyers and sellers of TLDs, both as a principal and as a third party.

My background outside of Handshake domains is in commercial real estate. Domains are not real estate, and not all concepts carry over because certain market mechanics and asset characteristics are inherently different, not the least in their tangibility (or lack thereof). Nonetheless, the similarities – true asset uniqueness; the relevance of adjacencies, assemblages, and traffic; and diversity of potential monetization strategies, among others – outweigh the differences in my mind. Readily available market data greatly facilitates many aspects of the commercial real estate industry, and I share the viewpoint that increased standardization and availability of data has facilitated its institutionalization over the past several decades. More bluntly, access to quality information paves the way for a broader potential investor base and higher valuations. As a bonus, within Handshake’s culture of reinvestment, sale proceeds one day might become a developer grant the next. This results in an ecosystem with the potential for at least some degree of shared prosperity (and, decentralization be damned, some intertwining of fates).

Survey responses, market activity during 2021 (and the beginning of 2022), and near-daily headlines capture the growing enthusiasm for and awareness of Handshake. Between new international registries, more reports of Namers “going full-time,” M&A rumors, and community stewardship of events and resources, there is an ever-growing network of significant investment in – and brainpower dedicated to – the Handshake ecosystem. It is an exciting time to be a part of the Handshake ecosystem.

Do you have additional opinions or predictions to share about topics covered in the report? If so, please share them in the comments below.

ABOUT US

To learn more about blockdomains/, please visit:

HNS: blockdomains/

Legacy: blockdomains.hns.to/

DISCLAIMER AND DISCLOSURE

This blog is not intended to be investment advice. Please consult appropriate investment, financial planning, legal and tax professionals prior to making any investment decisions. The author owns, has sold and acquired, and may sell and/or acquire in the future various Handshake TLDs. Information contained here has been obtained from third-party sources and is believed to be reliable. However, blockdomains/ has not independently verified that third-party information and makes no representations or guarantees of any kind regarding its accuracy and completeness and details provided herein.

❤️❤️❤️❤️❤️